Create Your Legacy: Join the Legacy Society

In 2021, we created our Legacy Society, which enables those who include Next Door Solutions in their estate and financial planning to be recognized formally as Legacy Society Members.

As a donor, you work directly with your own attorney or financial advisor, evaluating the best fit for you. There are many ways to leave a legacy.

Once you’ve included Next Door Solutions in your plans, you’ll submit a signed Donor Commitment form to us by mail or online. There is no other legal form to fill out, and you don’t need to declare what the gift is or will be, nor provide a copy of your bequest or financial documents. That’s it.

We will acknowledge receipt and you’ll be recognized as a member. You may choose to have your name listed, or remain anonymous, in our Annual Report and online/printed materials. You’ll also be invited to additional benefits such as special member events.

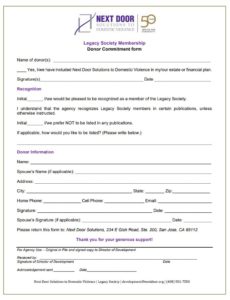

Legacy Society Membership

Donor Commitment form

Click on image to download form

Information for you, your attorney and/or financial advisor:

Next Door Solutions is establishing a Legacy Society as part of our 50th Anniversary, to honor individuals and families who have generously chosen to support the agency’s mission to end domestic violence in the moment and for all time, in their estate or financial planning. Legacy Society members will have a profound positive impact on the thousands of survivors and their the children that we serve.

Next Door Solutions to Domestic Violence is a 501(c)(3) nonprofit organization, Tax ID Number: 94-2420708. Our address is 234 E Gish Road Ste. 200, San Jose, CA 95112.

The Legacy Society recognizes the thoughtful planning and generosity of its members by inviting members to special events and recognizing them in publications (unless they request to remain anonymous). There are many ways to leave a legacy. Donors can work directly with their attorney or financial advisor. You can support our agency’s work and become a member with any of the following:

Bequests or Estate Gifts: By including Next Door Solutions to Domestic Violence in your will or revocable trust, you can make a significant gift through your estate, while retaining control and use of your assets during your lifetime. You can adapt the following language when talking with your financial advisor or attorney: “I give $___ (or ___% of my estate/trust) to Next Door Solutions to Domestic Violence – Tax identification number 94-2420708. Next Door Solutions to Domestic Violence is a California nonprofit entity under section 501(c)(3) of the Internal Revenue Code.”

Retirement Plan Gifts: Designating Next Door Solutions to Domestic Violence as a beneficiary of your retirement plan (IRA, 401k, etc.) is an easy way to give. Retirement assets are subject to heavy taxation when left to individuals, but are tax-free when left to charity. This type of gift enables you to maximize your charitable legacy, while leaving your family more tax-efficient assets.

Life Insurance Gifts: consider naming to Next Door Solutions to Domestic Violence as a beneficiary or owner of the existing policy.

Charitable Remainder Trust: By establishing a charitable remainder trust, you or a loved one can receive income for life while making a meaningful gift to the agency from the remainder.

Charitable Gift Annuity: Next Door Solutions to Domestic Violence does not issue Charitable Gift Annuities directly, but you can name the agency as the remainder beneficiary of a Charitable Gift Annuity issued by another charity, such as the Silicon Valley Community Foundation. This gift also gives you or a loved one income for life, making a meaningful gift to Next Door Solutions to Domestic Violence from the remainder.

Donor Advised Fund (DAF): Streamline estate planning. If your will or trust includes a gift to your Donor Advised Fund, you can contact the DAF manager to name Next Door Solutions as a beneficiary of your DAF. This would normally be a simple online election. Your Donor Advised Fund gift may be eligible to be matched this year! Donors who pledge to spend down half of his or her DAF this year, as a result of the #HalfMyDAF movement, may be matched on September 30th. Visit the #HalfMyDAF website to learn more.